L-MOUNT Forum

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Market share

- Thread starter pdk42

- Start date

xaviergut

LMF-Patron

Very interesting. The S9 with a more affordable and realistic price is helping too.

I have found this article about how the L-mount alliance could be a "problem" for the big 3...

fstoppers.com

fstoppers.com

With interesting points:

I have found this article about how the L-mount alliance could be a "problem" for the big 3...

Are Sigma and Panasonic Coming for Canon, Nikon, and Sony?

Every so often, a product launch doesn’t just release something new. Rather, it changes the tone of an entire ecosystem. This is what Sigma has just done with two lenses that, on their own, would be remarkable, but together feel like a tectonic movement. And they show that the big three (Canon...

With interesting points:

Ecosystem Chess: How Leica, Sigma, and Panasonic Align

The L-Mount Alliance only works because each member plays a specific role.- Leica is the architect. They created the mount, maintain its standards, and provide the brand prestige that makes the system credible. Without Leica, L-Mount would be just another third-party standard. With Leica, it has heritage.

- Sigma is the disruptor. They supply lenses at a pace and price point that neither Leica nor Panasonic could match. Their catalog is vast, and their willingness to experiment gives the system its wow factor.

- Panasonic is the executor. They build the bodies, maintain the infrastructure, and give the Alliance its volume. They are the engine that ensures L-Mount isn’t just a boutique option but a living, breathing ecosystem.

Nevyn72

LMF-Patron Gold

Yeah, but limited in fps - Sony doesn't allow higher than 15fps for third-party lenses on their bodies...But I assume that Sigma will offer these lenses (200mm f2 and 300-600 f4) will be made available for Sony too?

Just might make a difference for the once in a lifetime killer shot

GeorgeHudetz

Well-Known Member

I wonder what the Panasonic executives consider to be a good market share number. Or, perhaps more importantly, a bad market share number.

Quentinquirelino

Well-Known Member

I don't think there are evaluating the market share of the hole market as important. Panasonic isn't competing in every camera category. There are people only evaluating more specific market shares, like market share in full frame cameras between 1000-3000 $, because the S5II, S5IIX and S9 compete in this category. And they have probably also a category for the G9II and GH7 in which they compete and evaluate the market share in that category.I wonder what the Panasonic executives consider to be a good market share number. Or, perhaps more importantly, a bad market share number.

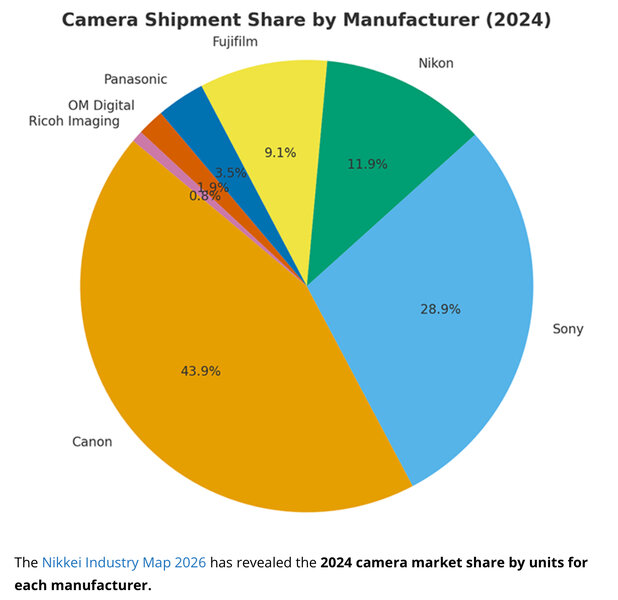

Canon for example has by far the biggest market share, but most of it comes from the APS-C camera's like beyond 1k USD (R100, R10, R50, etc) and because there are still selling DSLRs and compact cameras. At most time of 2024, Panasonic had only one model beyond 1k and no DSLR and every Compact camera where discontinued. In 2024 DSLRs still made about 12 % of the market and fixed lens cameras made about 22 % of the market (all according Cipa numbers). Also they didn't complete in high end cameras for above 3k, but I don't know how big that segment is. But all in all Panasonic didn't actually complete in over 1/3 of the market in 2024. So it doesn't make sense for them to evaluate there share for the hole market. Actually the only manufacturer who was competing in every category is Canon and that's also the reason they are no. 1, by far. Sony and Fuji didn't make DSLRs, Nikon didn't make compact cameras, Panasonic and OM didn't make DSLRs and compact cameras (Panasonic for most of 2024) and Ricoh didn't make mirrorless cameras.

However Panasonic started making compact cameras again in 2024 and released the TZ99 (available only since early 2025). Panasonic's market share (only data for Japan) jumpy from zero to almost 15 % because of the TZ99. So don't be surprised Panasonic's market share will rise for 2025. But it's not only due to the S1II series, also the TZ99 will have an impact.

Last edited:

Markuswelder

Well-Known Member

I think Panasonic cares more about profitability than market share. If a particular product isn't profitable, it disappears from their lineup. Think GX series and the GM1/5 in m4/3. If it's profitable, it stays. Think G, (even the much maligned G100) and GH cameras.

Even outside of cameras. Take a look at the Tough book laptop line. Market share must be miniscule, but they keep on manufacturing them. Market share is great, as long as it's also profitable.

They've also got a long history in video, it looks like stills is almost secondary to that, so there's that too

Even outside of cameras. Take a look at the Tough book laptop line. Market share must be miniscule, but they keep on manufacturing them. Market share is great, as long as it's also profitable.

They've also got a long history in video, it looks like stills is almost secondary to that, so there's that too

pdk42

Moderator

But I think in mass-market consumer electronics, market share and profit are probably closely correlated.I think Panasonic cares more about profitability than market share. If a particular product isn't profitable, it disappears from their lineup. Think GX series and the GM1/5 in m4/3. If it's profitable, it stays. Think G, (even the much maligned G100) and GH cameras.

Even outside of cameras. Take a look at the Tough book laptop line. Market share must be miniscule, but they keep on manufacturing them. Market share is great, as long as it's also profitable.

They've also got a long history in video, it looks like stills is almost secondary to that, so there's that too

GeorgeHudetz

Well-Known Member

These all seem like reasonable points. I'm sure any boardroom presentation on quarterly or yearly results will be more nuanced than a simple number, although I suspect they do show that number as well.I don't think there are evaluating the market share of the hole market as important. Panasonic isn't competing in every camera category. There are people only evaluating more specific market shares, like market share in full frame cameras between 1000-3000 $, because the S5II, S5IIX and S9 compete in this category. And they have probably also a category for the G9II and GH7 in which they compete and evaluate the market share in that category.

Canon for example has by far the biggest market share, but most of it comes from the APS-C camera's like beyond 1k USD (R100, R10, R50, etc) and because there are still selling DSLRs and compact cameras. At most time of 2024, Panasonic had only one model beyond 1k and no DSLR and every Compact camera where discontinued. In 2024 DSLRs still made about 12 % of the market and fixed lens cameras made about 22 % of the market (all according Cipa numbers). Also they didn't complete in high end cameras for above 3k, but I don't know how big that segment is. But all in all Panasonic didn't actually complete in over 1/3 of the market in 2024. So it doesn't make sense for them to evaluate there share for the hole market. Actually the only manufacturer who was competing in every category is Canon and that's also the reason they are no. 1, by far. Sony and Fuji didn't make DSLRs, Nikon didn't make compact cameras, Panasonic and OM didn't make DSLRs and compact cameras (Panasonic for most of 2024) and Ricoh didn't make mirrorless cameras.

However Panasonic started making compact cameras again in 2024 and released the TZ99 (available only since early 2025). Panasonic's market share (only data for Japan) jumpy from zero to almost 15 % because of the TZ99. So don't be surprised Panasonic's market share will rise for 2025. But it's not only due to the S1II series, also the TZ99 will have an impact.

It would be interesting learn how the R&D budget for Lumix compares to the big 3. Hopefully Panasonic can squeeze more profit out of each Yen spent on R&D (and other expenses) vs. Canon/Sony/Nikon.

Markuswelder

Well-Known Member

They are, but not an absolute necessityBut I think in mass-market consumer electronics, market share and profit are probably closely correlated.

Travis Butler

Well-Known Member

And in fact they can be negatively correlated - see the old saw about selling below cost, but making it up in volume.They are, but not an absolute necessity

Or to put it another way - chasing market share at the cost of profitability is a losing strategy, unless you have a way to turn the market share into profitability after you’ve got it. Which I think is risky; if you get market share with people going for the low price, you’re going to have trouble keeping them if you raise prices later to turn a profit.

Markuswelder

Well-Known Member

Yes. Especially in this day and age. Maybe 10 years or so ago when Sony went all in, not so much now. The numbers just aren't there.And in fact they can be negatively correlated - see the old saw about selling below cost, but making it up in volume.

Or to put it another way - chasing market share at the cost of profitability is a losing strategy, unless you have a way to turn the market share into profitability after you’ve got it. Which I think is risky; if you get market share with people going for the low price, you’re going to have trouble keeping them if you raise prices later to turn a profit.

The other way, is going premium, or upmarket to compensate for volume. That's pretty risky too. Take a look at Harley Davidson for example. They'ye really struggling right now I believe, as their older, well heeled customer base is literally dying off, with no new, younger customers to continue buying in. KTM have had big issues too, trying to go too big too soon with big volumes, they're extremely lucky to still be in business.

I know it sounds really fanboi-ish, but I get the impression that they do have a plan, and are sticking to it. I'd personally be more concerned about that battery mega factory they've just built taking them down, than not selling large volumes of mirrorless cameras. But that's just me, and what would I know.

Quentinquirelino

Well-Known Member

Sales numbers and profit are directly correlated. And sales numbers and market share are directly correlated. So there is a correlation. But there are a few buts.But I think in mass-market consumer electronics, market share and profit are probably closely correlated.

But the market share is also influenced by the sales numbers of the competition.

But without knowing the margins, you don't know the correlation.

A company can have increased profits despite loosing market share and every despite having lower sales numbers. Actually every current manufacturer has probably much lower sales numbers but higher margins than ten years ago. Some also have higher total profit than 10 years ago, despite having lost sales and market share.

10 years ago, Panasonic only sold m43 cameras and compact cameras. No full frame at all. Most of them for a under 1k. There average camera was probably much under 1 k.

Now they selling much more full frame cameras than m43. Most cameras they are selling are know around 2k. It's not hard to assume that Panasonic maybe even quadrupled there average camera sales price.

pdk42

Moderator

All that makes sense. Moreover, I suspect that the folks at Panasonic's imaging business are really VERY interested in market share, especially given their late entry into the full-frame market. Consumer electronics has a very expensive R&D component to it since it's essential that the units can be produced at low cost, at volume, and with no costly after-sales service needs. So, they need volume sales to recover the R&D costs and to justify their presence in the market. Panasonic are not Leica, or even OM Systems. They are a huge multi-national corporation who focus on the mass market.Sales numbers and profit are directly correlated. And sales numbers and market share are directly correlated. So there is a correlation. But there are a few buts.

But the market share is also influenced by the sales numbers of the competition.

But without knowing the margins, you don't know the correlation.

A company can have increased profits despite loosing market share and every despite having lower sales numbers. Actually every current manufacturer has probably much lower sales numbers but higher margins than ten years ago. Some also have higher total profit than 10 years ago, despite having lost sales and market share.

10 years ago, Panasonic only sold m43 cameras and compact cameras. No full frame at all. Most of them for a under 1k. There average camera was probably much under 1 k.

Now they selling much more full frame cameras than m43. Most cameras they are selling are know around 2k. It's not hard to assume that Panasonic maybe even quadrupled there average camera sales price.

And if we look at the current state of the FF mirrorless market, it seems clear to me that Panasonic are fighting hard with pricing to gain market share. Their bodies in particular are definitely lower price, feature for feature, compared to Canon, Sony, or Nikon. And that's before the deep discounting they do relatively early in the life of their models (e.g. the recent S9 deals in the UK).

Travis Butler

Well-Known Member

You mean the battery factory that’s about 20 minutes up the road from me? ^^;;I'd personally be more concerned about that battery mega factory they've just built taking them down, than not selling large volumes of mirrorless cameras. But that's just me, and what would I know.

I think the big issue there is that it was started when the assumption was that EVs were going to dominate, and finished when the administration in power really dislikes EVs. But the local hiring has been robust, and the hiring managers don’t seem to have any doubts.

Markuswelder

Well-Known Member

And they've said on a number off occasions, that they're very happy with how things are progressing. Exceeding expectations if my memory serves me correctly.Moreover, I suspect that the folks at Panasonic's imaging business are really VERY interested in market share, especially given their late entry into the full-frame market.

Panasonic is not Olympus -they don't say one thing then go off and do another. A year or two back they said they're not interested in releasing new models for the sake of it, they'll only release them when they has actual proper upgrades to the model line. And that's pretty much been the case. Not just bold new graphics or new clothes.

Like I wrote, I think they have a plan, they're happy with it, and seems to be working. Without having to go into "reading the Tea leaves"

Quentinquirelino

Well-Known Member

Well, but it's not about the total market. Like I said in my first comment, the total market includes significant proportions of categories in which Panasonic don't even compete. They never produced DSLRs, they dropped fixed lens cameras before they reentered the market for it, they didn't produce cameras for more than 3k and almost none for under 1k. So it doesn't make much sense to look only on the total market share.All that makes sense. Moreover, I suspect that the folks at Panasonic's imaging business are really VERY interested in market share, especially given their late entry into the full-frame market. Consumer electronics has a very expensive R&D component to it since it's essential that the units can be produced at low cost, at volume, and with no costly after-sales service needs. So, they need volume sales to recover the R&D costs and to justify their presence in the market. Panasonic are not Leica, or even OM Systems. They are a huge multi-national corporation who focus on the mass market.

And if we look at the current state of the FF mirrorless market, it seems clear to me that Panasonic are fighting hard with pricing to gain market share. Their bodies in particular are definitely lower price, feature for feature, compared to Canon, Sony, or Nikon. And that's before the deep discounting they do relatively early in the life of their models (e.g. the recent S9 deals in the UK).

But of course it makes sense to look at the market segments they are actually completing and how they are doing there. So they will look in full frame sales and full frame market share. And if you want to do that, you will find out, they are actually doing quite good. Somewhere else, I have read, Panasonic sold more than 200k full frame cameras in 2024 and only the rest of the total 280k sales are m43. The total market volume for full frame in 2024 was something between 2 and 2.5 million. That means they have about 8 to 10 % of the full frame market. That does fit well to the data we have got from Europe and Japan.

pdk42

Moderator

That’s good news.Somewhere else, I have read, Panasonic sold more than 200k full frame cameras in 2024 and only the rest of the total 280k sales are m43. The total market volume for full frame in 2024 was something between 2 and 2.5 million. That means they have about 8 to 10 % of the full frame market. That does fit well to the data we have got from Europe and Japan.

Markuswelder

Well-Known Member

Ha ha. I have no idea where you live, or even where the battery mega factory is located. But yeah, I don't think that battery cars have had the expected take up in the Western world. A little bit more government intervention and manipulation required perhaps. Hopefully Panasonic doesn't get badly burnt out of the whole circus anyway. Be a shame to see the digital camera division get wiped out through no fault of their own.You mean the battery factory that’s about 20 minutes up the road from me? ^^;;

CharlesH

LMF-Patron Gold

The Panasonic Megafactories in the USA primarily supply cells for Tesla. Tesla sales are down about 14% this year compared to 2024. I helped out, I replaced my 2021 Tesla with a new model.Ha ha. I have no idea where you live, or even where the battery mega factory is located.